Efficient management of account receivables (AR) is essential for maintaining a healthy

cash flow in any healthcare practice. With DocVaz’s AR follow-up services, you can

ensure your revenue is collected on time and without delays. Our team of experts

focuses on enhancing your AR procedures to prevent revenue losses and maximize

your practice’s financial potential.

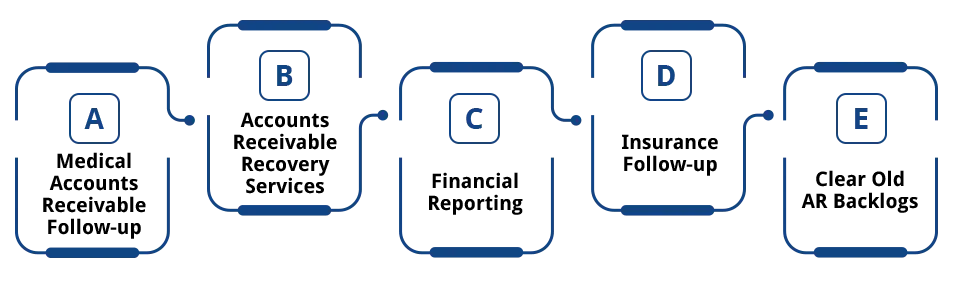

At DocVaz, we specialize in account receivables follow-up services designed to help your healthcare practice collect payments more efficiently. As soon as claims are submitted to insurance providers, we initiate the follow-up process to ensure timely reimbursement. Our approach to account receivables management not only focuses on recovering denied or rejected claims but also on preventing future delays.

Managing account receivables is critical to the financial health of any healthcare organization. With our account receivables solutions, you can prevent revenue delays and reduce the burden of outstanding claims. Outsourcing your AR follow-up to DocVaz allows you to focus on providing quality patient care while we handle the complexities of claim resubmission, denied claims, and revenue recovery.

Inefficient AR processes can lead to delayed payments, leaving a significant portion of your revenue uncollected. At DocVaz, our expert account receivable services are backed by over 20 years of industry experience, allowing us to efficiently manage your AR follow-up process and ensure timely payments.

We understand the unique challenges of account receivables in healthcare and know how to navigate them effectively. Here’s how our proven AR management expertise can benefit your practice:

Get Paid Faster: Prioritize AR Follow-Ups

Your revenue shouldn’t be delayed. With our AR recovery system,

you can unlock faster payments through timely and strategic

follow-ups. Here’s how we make it happen:

Don’t let delayed payments hold your practice back. Partner with

DocVaz for efficient account receivables solutions that drive faster

payments and smoother operations.

Failing to follow up on claims can lead to significant revenue losses for medical practices. Did you know that 30% of claims require resubmission after the initial attempt? Even more troubling, a large portion of these claims are never recovered, resulting in undercompensated healthcare services. By partnering with DocVaz, you can bridge this revenue gap and ensure your practice receives the compensation it deserves.

Account receivables refer to the outstanding payments a healthcare practice is owed after providing services. These are typically payments from insurance companies that are pending collection.

An AR follow-up is the process of actively managing and collecting outstanding payments. This includes following up on denied or delayed claims to ensure timely payment.

Outsourcing account receivables follow-up services can improve cash flow by reducing delays, recovering lost revenue, and minimizing the administrative burden on your staff.

Claims are often denied due to errors in coding, missing information, or payer guidelines. DocVaz helps identify these issues and resubmits denied claims to maximize reimbursement.

Our streamlined follow-up process prioritizes claims based on their potential for recovery, ensuring that payments are collected as quickly as possible.